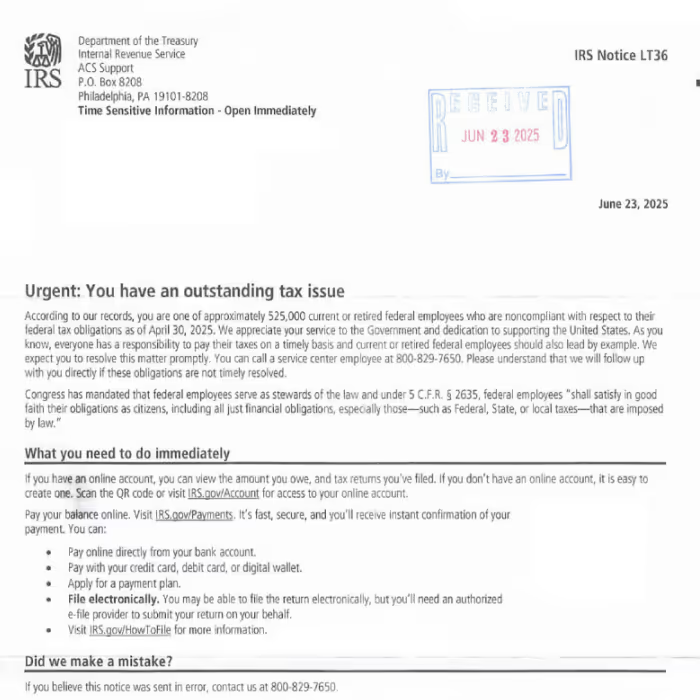

The Internal Revenue Service has begun issuing LT36 notices to current and retired federal employees who have an “outstanding tax issue” as of April 30, 2025, notifying these taxpayers of their responsibility to pay their taxes and to “resolve this matter promptly.”

The letter indicates that the taxpayer must take immediate action to pay their balance or file outstanding returns.

Recipients are instructed to immediately:

The notice also provides a contact number (800-829-7650) if the recipient believes the notice was sent in error.

Taxpayers who do not address their outstanding tax issues may be subject to aggressive IRS collection measures as governed by the Federal Employee/Retiree Delinquency Initiative (“FERDI”).

Under FERDI, the IRS may garnish wages, salaries, pension benefits, and Social Security benefits using the Federal Payment Levy Program.1 Because of this, the LT36 should not be ignored and taxpayers should act quickly to resolve their outstanding tax issues.

FERDI applies to civilian employees, civil service or Federal Employee Retirement System (“FERS”) retirees, active duty military, military retirees, and National Guard/Reservists. Most FERDI cases are handled by the IRS’ Automated Collection System (“ACS”), unless the aggregate assessed balance exceeds $1 million or the taxpayer is an employee of the IRS. Notably, taxpayers who serve in a combat zone are entitled to special procedures which suspend collection activities during their service.2

If you have questions about your IRS notice and your options to address your outstanding tax issues and would like to discuss your case in detail, don't hesitate to reach out to us at (410) 497-5947 or schedule a confidential consultation with our team of tax attorneys.

The Internal Revenue Service has begun issuing LT36 notices to current and retired federal employees who have an “outstanding tax issue” as of April 30, 2025, notifying these taxpayers of their responsibility to pay their taxes and to “resolve this matter promptly.”

The letter indicates that the taxpayer must take immediate action to pay their balance or file outstanding returns.

Recipients are instructed to immediately:

The notice also provides a contact number (800-829-7650) if the recipient believes the notice was sent in error.

Taxpayers who do not address their outstanding tax issues may be subject to aggressive IRS collection measures as governed by the Federal Employee/Retiree Delinquency Initiative (“FERDI”).

Under FERDI, the IRS may garnish wages, salaries, pension benefits, and Social Security benefits using the Federal Payment Levy Program.1 Because of this, the LT36 should not be ignored and taxpayers should act quickly to resolve their outstanding tax issues.

FERDI applies to civilian employees, civil service or Federal Employee Retirement System (“FERS”) retirees, active duty military, military retirees, and National Guard/Reservists. Most FERDI cases are handled by the IRS’ Automated Collection System (“ACS”), unless the aggregate assessed balance exceeds $1 million or the taxpayer is an employee of the IRS. Notably, taxpayers who serve in a combat zone are entitled to special procedures which suspend collection activities during their service.2

If you have questions about your IRS notice and your options to address your outstanding tax issues and would like to discuss your case in detail, don't hesitate to reach out to us at (410) 497-5947 or schedule a confidential consultation with our team of tax attorneys.