Employee Retention Credit (ERC): Key Events 2022-2025

This timeline tracks significant developments surrounding the Employee Retention Credit (ERC) from 2022 to 2025. Many firms that marketed ERC claims to small businesses as part of pandemic relief under the CARES Act, have been embroiled in lawsuits, federal investigations, and growing IRS scrutiny over improper claims and misleading practices. If you find yourself in a dispute or a lawsuit with an ERC provider feel free to contact our firm for an independent review and advice. Lawsuits involving ERC providers can be intricate, as the IRS has noted that the Employee Retention Credit (ERC) is the most complex credit it has ever managed.

With ongoing federal audits, lawsuits, and voluntary disclosure programs, this timeline captures the complex and contested landscape of the ERC, shedding light on the legal, financial, and regulatory battles surrounding this key pandemic-era tax credit.

Use the timeline below put together by our tax attorneys to learn more about ERC refund processing time updates and fraudulent ERC provider details released by the IRS in 2022, 2023, 2024 and 2025. It also tracks the many lawsuits filed and litigation efforts made related to the ERC. If you have any questions, contact our team by calling (410) 497-5947 or clicking here for a free consultation.

October 22, 2025

IRS Issues Formal Guidance on OBBBA Restrictions and Final ERC Refund Deadlines

The IRS released Fact Sheet FS-2025-7 to clarify the administrative effect of the One Big Beautiful Bill Act (OBBBA) on the ERC program. The guidance confirmed a critical legislative restriction: the IRS is prevented from allowing or refunding 2021 Q3/Q4 ERC claims if they were filed after January 31, 2024, and the refund was not received before July 4, 2025.

October 7, 2025

New Penalty Relief Under OBBBA

The Treasury and IRS issued guidance providing deposit penalty relief in connection with a new excise tax imposed on certain remittance transfers under the OBBBA. This administrative effort is part of the IRS's resource dedication to implementing sweeping new tax laws, a factor which likely contributes to the continued delays and complexity in the ERC program by stretching the agency's focus and capacity.

October 2, 2025

Statute of Limitations Crisis Spurs Litigation Concerns Amid ERC Appeal Backlogs

By this date, a growing crisis emerged as the two-year statutory deadline for taxpayers to file suit after receiving an ERC disallowance began to approach. Since the administrative appeals process does not pause this clock, taxpayers were forced to either file Form 907 to extend the deadline or pursue immediate refund litigation in federal court to preserve their right to a refund.

October 1, 2025

Federal Government Shutdown Halts ERC Appeals, Worsening Backlog Crisis

The commencement of a federal government shutdown on this date immediately suspended all scheduled ERC appeals conferences and halted administrative support from the Taxpayer Advocate Service (TAS). The resulting delays placed many taxpayers at risk of missing the crucial two-year statutory deadline to file suit in federal court against claim disallowances.

September 12, 2025

Major Lawsuit Filed Over Unauthorized Use and Sharing of 22,000 Taxpayers' ERC Data

A lawsuit, Tax Guardian LLC v. TaxStatus Inc., was filed alleging the unauthorized retention and subsequent sharing of approximately 22,000 taxpayers' IRS data with a separate ERC claim preparer. This action highlighted severe data privacy risks and governance failures within the high-volume ERC preparation industry, raising potential violations of federal law, including IRC Section 6103.

September 12, 2025

Payroll Companies Sued Over Withheld ERC Refunds

Amid ramped-up IRS enforcement, a growing number of businesses are suing their payroll companies, alleging they have not received their owed Employee Retention Credit (ERC) refunds. Businesses claim these companies are withholding payments, including interest, out of concern for their own liability for inaccurate claims, leading to a surge in legal disputes.

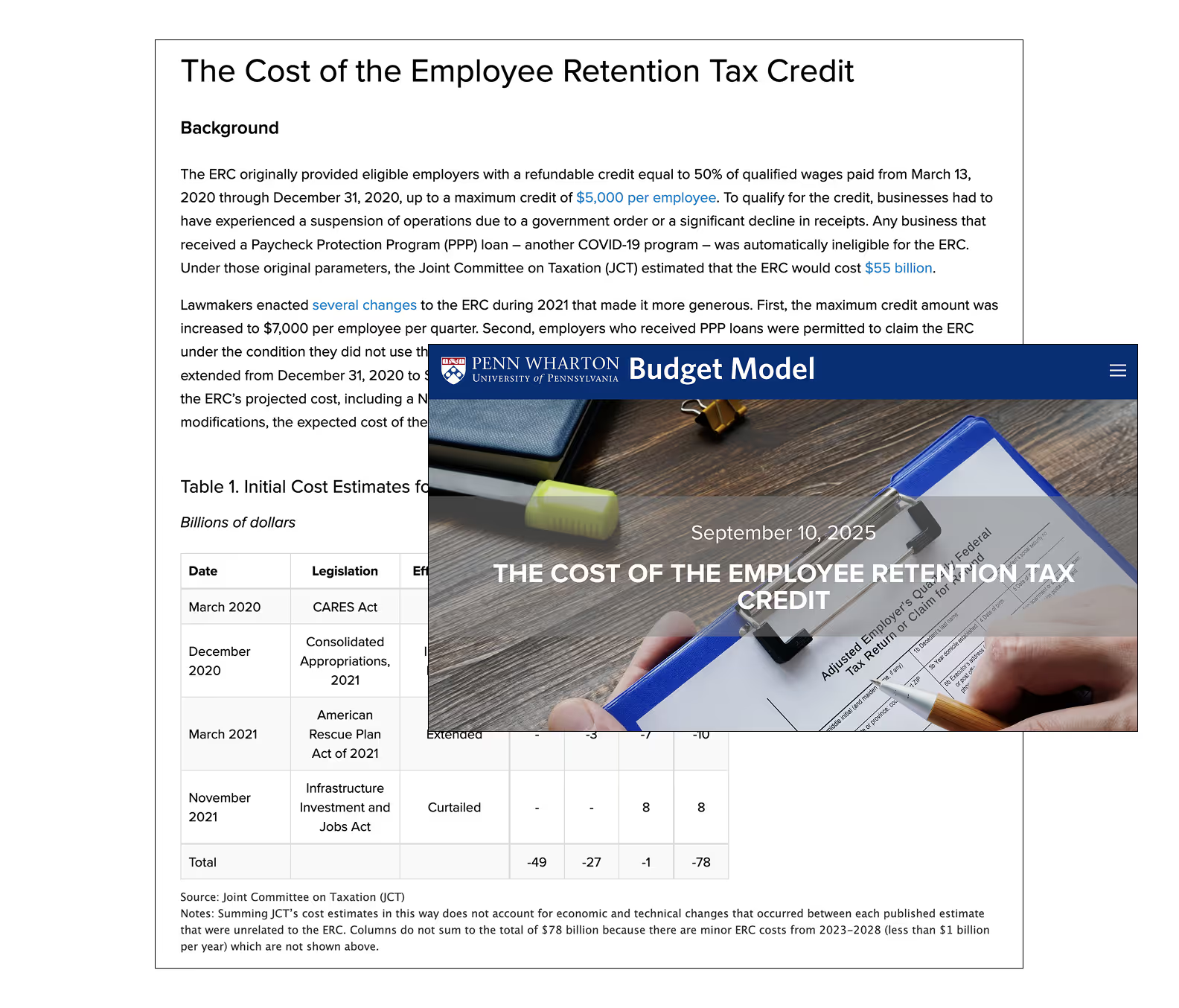

September 10, 2025

The Cost of the Employee Retention Tax Credit

As of September 10, 2025, the estimated final cost of the Employee Retention Credit (ERC) was projected to exceed $300 billion, nearly quadruple its original estimate, due to an extended claiming period and a surge in questionable claims. This immense financial impact underscored the necessity of the IRS's moratorium and enhanced ERC enforcement efforts. The analysis shifted the conversation to the long-term financial stability of the program and the ongoing necessity of rigorous ERC compliance to combat widespread fraud.

August 26, 2025

NAPEO/IRS Meeting: PEOs Still Hold ERTC Liability Under Proposed OBBA

On August 26, 2025, the National Association of Professional Employer Organizations (NAPEO) requested an urgent meeting with the Secretary of the Treasury to address two critical issues causing major delays and liability concerns for the Employee Retention Credit (ERC). The primary issues were the IRS's interpretation of PEO liability for incorrect ERC claims, and the procedural "mess" created by the retroactive filing deadlines and unclarified rules from the One Big Beautiful Bill Act (OBBBA). This action highlighted the severe uncertainty and frustration surrounding the ERC process, particularly for the 200,000 small businesses that rely on PEOs.

August 7, 2025

IRS Gets Favorable Result in Bankruptcy Court Opinion: What Is an Order? What Is a Suspension? Who Decides?

On August 7, 2025, the IRS secured a highly favorable result in the JSmith Civil LLC bankruptcy case, marking the first court decision to strictly define key Employee Retention Credit (ERC) eligibility terms. The court defined a partial suspension as a "temporary stoppage of a portion of operations" and, crucially, ruled that a governmental order must be "compulsory" with repercussions for noncompliance. This decision set a new, more onerous judicial standard for claiming the ERC under the partial suspension test and immediately bolstered the IRS's ability to deny claims, despite the ruling itself lacking formal precedential weight.

July 4, 2025

Employee Retention Credit Rules Are Still Progressively Evolving

As of July 4, 2025, the One Big Beautiful Bill Act (OBBBA) significantly changed the state of the Employee Retention Credit (ERC) by retroactively terminating claims for the third and fourth quarters of 2021 that were filed after January 31, 2024. The Act also extended the statute of limitations for IRS audits of all ERC claims to six years and introduced new penalties for promoters and excessive claims. This created immediate uncertainty for many claimants while greatly bolstering the IRS's ability to scrutinize ERC compliance and combat fraud.

June 27, 2025

New Policies Start to Influence Criminal Tax Enforcement

The IRS signaled a major shift in the Employee Retention Credit (ERC) landscape by actively using new policies to increase criminal tax prosecutions and enforcement against fraud. This surge in indictments and convictions, specifically targeting ERC promoters and improper claims, emphasized the agency's commitment to ensuring ERC compliance and served as a stark warning to all taxpayers regarding ERC eligibility.

June 23, 2025

IRS Issues CP504B Balance Due Notices for ERC Claims, Escalating Collection Actions

The IRS dramatically escalated its enforcement on the Employee Retention Credit (ERC) by issuing CP504B balance due notices, which signaled an imminent collection action and an intent to levy against taxpayers. This shift meant the ERC process moved beyond initial audits to immediate collection, requiring recipients to act fast. Instead of paying, taxpayers were forced to file a Collection Due Process (CDP) hearing request within 30 days to preserve their right to challenge the underlying assessment in Tax Court.

June 20, 2025

Judicial Upholding of IRS ERC Guidance

On April 22, the IRS unveiled a new website discussing Letter 106C. Soon after, it began issuing Letter 106C, a partial disallowance notice for Employee RetentioThe U.S. District Court for the District of Arizona denied a challenge in Stenson Tamaddon LLC v. IRS, ruling that IRS Notice 2021-20 (the agency's foundational ERC guidance) was an "interpretive rule," not subject to the formal notice-and-comment procedures of the Administrative Procedure Act (APA). This preserved the validity of the IRS's original guidance framework.n Credit (ERC) claims, signaling a new era of heightened scrutiny and audits. This development requires taxpayers to be prepared to challenge these partial disallowances with the IRS Independent Office of Appeals within a 30-day window to preserve their ERC refund claims.

April 22, 2025

IRS Letter 106C: ERC Partial Disallowance and How to Respond

On April 22, the IRS unveiled a new website discussing Letter 106C. Soon after, it began issuing Letter 106C, a partial disallowance notice for Employee Retention Credit (ERC) claims, signaling a new era of heightened scrutiny and audits. This development requires taxpayers to be prepared to challenge these partial disallowances with the IRS Independent Office of Appeals within a 30-day window to preserve their ERC refund claims.

April 18, 2025

Employee Retention Credit Interest: It's What Makes the Waiting Worth It

Businesses awaiting their Employee Retention Credit (ERC) refunds became more aware of the significant interest component due on overpayments, especially for those who filed Form 941-X. This development highlighted a new challenge, as many businesses—particularly those that used PEOs—were not receiving the correct interest amounts from the IRS, underscoring the need to verify these calculations.

April 15, 2025

The ERC Claim Period Has Closed—What Happens Now?

On April 15, 2025, a critical phase of the Employee Retention Credit (ERC) program ended, as the deadline for filing original claims for all of 2020 officially closed. This landmark event signaled a transition in the ERC landscape, moving the focus from new filings to IRS enforcement and compliance. As a result, businesses were urged to prioritize securing their submitted ERC refunds and preparing for potential IRS audits with robust documentation.

April 2, 2025

Businesses Who Utilized PEOs to File for ERC Should Request Documentation Related to Filings

Businesses that used Professional Employer Organizations (PEOs) to claim the Employee Retention Credit (ERC) were urged to request documentation to verify their claims before the April 15th deadline for 2021 claims. This was due to PEOs filing under their own Employer Identification Number (EIN), making it difficult for businesses to track their refund status and ensure compliance. This news made it clear that businesses needed to secure their own records to protect their ERC claims through Schedules R and IRS Form 941.

March 27, 2025

The Three Main ERC Scenarios in 2025

The Employee Retention Credit (ERC) process was complicated by the IRS's efforts to streamline operations and efficiently process ERC refund claims. These changes raised concerns about undermining the critical safety net provided by the Taxpayer Advocate Service (TAS). This shift meant that taxpayers facing complex ERC audits or ERC disallowance notices had less independent support, making it harder to ensure proper ERC compliance and challenge IRS determinations.

March 25, 2025

No More Paper Checks: What It Means for ERC Refunds

On March 25, 2025, President Trump signed an executive order mandating that all federal tax refunds, including Employee Retention Credit (ERC) refunds, will be disbursed via Electronic Funds Transfer (EFT) by September 30, 2025, eliminating paper checks. While there are exceptions, most ERC claimants are unlikely to qualify. This change requires businesses to ensure they had an active bank account to receive ACH payments and avoid delays in their ERC refund claims.

March 24, 2025

Gutting TAS’s Safety Net in the Interest of Efficiency

The Employee Retention Credit (ERC) process was complicated by the IRS's efforts to streamline operations and efficiently process ERC refund claims. These changes raised concerns about undermining the critical safety net provided by the Taxpayer Advocate Service (TAS). This shift meant that taxpayers facing complex ERC audits or ERC disallowance notices had less independent support, making it harder to ensure proper ERC compliance and challenge IRS determinations.

March 20, 2025

IRS ERC Guidance: Handling Income Tax Effects

New IRS guidance released on March 20, 2025, offers businesses a streamlined approach to handle the income tax effects of Employee Retention Credit (ERC) claims. Instead of amending prior year returns, employers may include the ERC amount as income in the year it was received, providing administrative relief. Employers should consult with a tax professional to determine their options.

March 20, 2025

Concerns With ERC Claims Filed by Your PEO

PEO, AdvanStaff HR, advised a client to sign an IRS Power of Attorney, raising concerns about potential conflicts of interest and the PEO's ability to protect the client's interests during ERC audits. Businesses are strongly advised to obtain all necessary ERC documentation directly from their PEOs, including redacted Schedule Rs, and consider seeking independent tax counsel to navigate potential IRS ERC compliance issues.

March 20, 2025

Tax Returns After Receiving ERC: What Taxpayers Need to Know

On March 20, 2025, the IRS released new guidance for taxpayers on how to handle the income tax effects of the Employee Retention Credit (ERC). This development provided a streamlined solution, allowing businesses to include the ERC as income in the year it was received, offering administrative relief and eliminating the need to amend prior-year returns to correct wage expense deductions.

March 17, 2025

Understanding Risks When Making ERC Attestations to Your PEO

Businesses relying on Professional Employer Organizations (PEOs) for their Employee Retention Credit (ERC) claims face significant risks, as many PEOs solely accept client attestations of eligibility without conducting a thorough analysis. This practice can lead to improper ERC claims, miscalculations, and potential compliance issues, especially with increased IRS scrutiny. Poorly substantiated ERC filings could result in penalties, interest, or the requirement to return disbursed refunds during an IRS ERC audit.

March 10, 2025

Claimed ERC Through a PEO? A Complex and Opaque Process

Businesses that utilized Professional Employer Organizations (PEOs) to claim the Employee Retention Credit (ERC) are facing significant transparency challenges. Because PEOs file Form 941-X under their own EIN with an attached Schedule R, which often lumps multiple clients, it is difficult for individual businesses to access specific ERC filing details or verify the status of their ERC refund claims. This lack of direct communication and individualized updates from PEOs can leave businesses vulnerable. Businesses are advised to request redacted Schedule R copies or account transcripts from their PEOs for independent verification of their ERC claims.

February 10, 2025

Dreaded Disallowances: Understanding IRS Letters 105C, 106C, and 6577C

As of early 2025, the IRS has significantly increased sending out Employee Retention Credit (ERC) disallowance notices, specifically Letters 105C, 106C, and 6577C, impacting businesses that claimed the ERC. Letter 105C is a full disallowance, often citing insufficient evidence of government-mandated partial suspension or gross receipts decline, while Letter 106C is a partial disallowance, typically due to discrepancies in claimed wages. Letter 6577C proposes a change after a refund has been issued, often questioning the number of eligible employees. Taxpayers receiving these IRS ERC audit letters have options including inaction, protesting the notice to the Independent Office of Appeals, or litigating the claim in federal court.

January 22, 2025

NAPEO Urges Modernization and Faster ERC Processing

The National Association of Professional Employer Organizations (NAPEO) sent a letter to President Donald J. Trump, calling for IRS modernization and improved ERC refund processing. The organization criticized outdated IRS systems and slow credit disbursement, while urging regulatory clarity and expedited payments for small businesses. The letter was also addressed to IRS Commissioner-Nominee Billy Long. NAPEO emphasized the detrimental impact of IRS inefficiencies on small businesses that rely on timely ERC refunds to sustain operations. Many third-party payroll and HR service providers likewise support calls for modernization to ensure that businesses can benefit from quicker, more efficient ERC processing. The organization also proposed enhanced digital solutions for tax processing to improve efficiency and minimize delays.

January 10, 2025

National Taxpayer Advocate Highlights ERC Processing Issues in Annual Report to Congress

The National Taxpayer Advocate’s Annual Report to Congress identified ERC processing delays as a major issue. The report criticized long wait times, inconsistent claim processing, and uncertainty regarding refunds. It emphasized financial distress among businesses and called for increased transparency, better communication, and a more efficient resolution process.

December 13, 2024

Taxpayer Advocate Service Responds to IRS ERC Recapture Letters

The Taxpayer Advocate Service (TAS) issued guidance in response to the IRS's ERC recapture letters, advising businesses on how to navigate repayment or dispute the IRS’s claims. The TAS emphasized the financial strain on businesses and provided options for appeals, payment plans, and offers in compromise for those unable to pay. The report also highlighted concerns raised by business owners who had relied on ERC funds to stay operational and urged the IRS to enhance transparency and provide clearer instructions for taxpayers.

December 6, 2024

Support Holds for Congressional Action on ERC

As of December 6, 2024, there was strong bipartisan support in Congress for immediate legislative action on the Employee Retention Credit (ERC) due to concerns over fraud and escalating costs. Lawmakers and policy groups were actively advocating for a retroactive filing deadline and increased penalties to improve ERC compliance. This momentum in early 2025 created significant uncertainty about the program's future and signaled that major reforms were imminent.

November 22, 2024

Second ERC Voluntary Disclosure Program Closes

On November 22, 2024, the IRS’s second Employee Retention Credit Voluntary Disclosure Program officially closed. This program was designed to help businesses resolve improper ERC claims for the 2021 tax period. Eligible taxpayers had the opportunity to voluntarily repay 85% of the ERC received while avoiding penalties, interests, and the risk of audit. Those who participated were not required to amend income tax returns or repay interest received on ERC refunds.

November 21, 2024

IRS Extends Deadline for Third-Party Payers to Resolve ERC Claims

On November 21, 2024, the IRS announced an extension for third-party payers (TPP), such as professional employer organizations (PEO) or certified professional employer organizations (CPEO), to use the consolidated claim process to correct errant ERC claims. This original deadline was November 22, 2024, which has now been extended to December 31, 2024. You can learn more about this latest extension and the concerns of tax professionals who believe this program could negatively impact TPP clients.

September 26, 2024

Alpha Connection Youth & Family Services Sues Vensure Employer Services Over ERC Mismanagement by Third Party Payroll Provider

Alpha Connection Youth & Family Services filed a lawsuit against Vensure Employer Services in the Circuit Court of Hillsborough County, Florida, alleging breach of contract, breach of the implied covenant of good faith and fair dealing, and negligence. The nonprofit organization, which provides residential counseling and support for at-risk youth, claims that Vensure failed to properly manage payroll and tax-related filings, including the Employee Retention Credit. The lawsuit states that Vensure’s failure to meet its contractual obligations which resulted in financial harm to Alpha Connection, as it was unable to claim ERC refunds in a timely manner.

This case follows similar lawsuits against other Professional Employer Organizations (PEOs), where businesses have alleged mismanagement of payroll tax obligations, failure to process ERC claims, and other administrative failures. The case highlights ongoing concerns regarding the role of PEOs in handling employer tax credits and the risks faced by businesses that rely on third-party payroll providers for compliance with complex tax programs.

August 15, 2024

IRS Sends 30,000 ERC Recapture Letters and Reopens Voluntary Disclosure Program

On August 15, 2024, the IRS announced it would send up to 30,000 letters to businesses to recapture more than $1 billion in improper Employee Retention Credit (ERC) claims. These letters inform businesses of repayment obligations and potential penalties, signaling the agency’s heightened focus on compliance.

Simultaneously, the IRS reopened its Voluntary Disclosure Program (VDP) for businesses with improper ERC claims, offering a 15% discount on repayments and the chance to avoid future audits, penalties, and interest. Running until November 22, 2024, this second VDP follows the first iteration, which closed in March 2024 after more than 2,600 applications disclosed $1.09 billion in improper credits. The IRS is urging businesses to self-correct through the VDP before enforcement actions intensify, a move that may influence outcomes for those embroiled in lawsuits against Synergi Partners and others considering voluntary disclosure amidst potential Innovation Refunds lawsuits and Bottom Line Concepts lawsuits.

July 31, 2024

IRS Begins Issuing 105C Disallowance Letters, Initiating Formal ERC Claim Denials

The IRS formally initiated ERC claim denials by issuing Letter 105C disallowance notices, potentially affecting a projected half a million claims. This critical development immediately shifted the focus of the Employee Retention Credit (ERC) landscape toward litigation, as taxpayers were given a strict 30-day window to file a formal protest and a two-year statutory window to challenge the denial in federal court.

June 10, 2024

Seacrest Recovery CenterFiles Complaint Against Vensure Employer Services

On June 10, 2024, Seacrest Recovery Center LLC filed a lawsuit against Vensure Employer Services in the Circuit Court of Hillsborough County, Florida, alleging mishandling of Employee Retention Credit (ERC) refund funds. The complaint accuses Vensure Employer Services of receiving ERC refund checks on behalf of Seacrest Recovery but failing to transfer the funds to the recovery center as agreed. Seacrest contends that these actions have caused significant financial harm and seeks full restitution of the ERC funds along with additional damages. The dispute highlights how businesses can be left exposed if external payroll and HR providers lack proper safeguards when managing sensitive ERC transactions. This case, the latest Vensure lawsuit, underscores growing concerns over third-party ERC service providers and their practices. Similar lawsuits involving Synergi Partners, Innovation Refunds, and Bottom Line Concepts have highlighted the risks businesses face when relying on external firms to manage pandemic-related tax credits.

June 4, 2024

Stenson Tamaddon Files Motion for Preliminary Injunction Against IRS Moratorium

On June 4, 2024, Stenson Tamaddon, LLC filed a motion for a preliminary injunction against the IRS in the U.S. District Court for the District of Arizona. The motion challenges the IRS moratorium on processing ERC claims, arguing that the suspension, in place since September 14, 2023, is unlawful and harms businesses nationwide. Stenson Tamaddon claims that the IRS lacks the authority to unilaterally suspend the ERC program, which was mandated by Congress under the CARES Act to provide businesses with essential economic relief. The firm seeks to compel the IRS to resume processing ERC claims, highlighting the significant financial harm to businesses and the statutory duty of the IRS to process claims.

May 16, 2024

Stenson Tamaddon Files Lawsuit Against IRS and Treasury Department

On May 16, 2024, Stenson Tamaddon, a financial solutions firm, filed a lawsuit in Federal District Court against the Internal Revenue Service, the U.S. Department of the Treasury, IRS Commissioner Daniel Werfel, and Treasury Secretary Janet Yellen. The lawsuit challenges the IRS's handling of the ERC program, particularly the restrictions imposed by "Notice 2021-20," which the firm argues unlawfully narrowed ERC eligibility without following the procedures required by the Administrative Procedure Act (APA). The lawsuit seeks declaratory and injunctive relief and a writ of mandamus to compel the IRS to resume ERC claims processing, which had been suspended due to concerns of abuse within the program. Stenson Tamaddon claims that the IRS's actions were arbitrary, capricious, and outside the bounds of its authority, and the firm is pursuing the litigation to ensure businesses receive their rightful ERC benefits.

March 29, 2024

IRS Warns Against Aggressive ERC Promoters

The IRS issued a news release as part of its "Dirty Dozen" tax scams series, titled "Beware of aggressive promoters who dupe taxpayers into making questionable Employee Retention Credit claims; risks continue for small businesses, special withdrawal program remains available." The IRS warned small businesses about the ongoing risks posed by aggressive ERC promoters who mislead taxpayers into filing questionable claims. The IRS emphasized the importance of the special withdrawal program for those who may have been duped into filing improper ERC claims.

March 15, 2024

Law360: Ohio AmbulanceCo. Says HR Firm Botched Tax Returns

ValueCare Medical Logistics LLC, operating as ValueCare Ambulance Service, has filed a lawsuit against Vensure HR Inc. in Ohio federal court, alleging that the Arizona-based HR firm failed to properly prepare and submit amended tax returns to claim pandemic-era Employee Retention Credits under the CARES Act. ValueCare is seeking over $650,000 in damages related to the mishandling of its tax credit claims, along with $100,000 for unresolved payroll and benefits issues. The case was originally filed in state court and later moved to federal court due to the diversity of parties and the significant amount in controversy. In many instances, third-party payroll and HR providers may not have the specialized knowledge or processes required to handle the intricacies of ERC filings, leaving businesses vulnerable to serious financial and legal repercussions.

February 22, 2024

MB Automotive Specialists vs. ERC Specialists

MB Automotive Specialists filed a class-action lawsuit against ERC Specialists under the Illinois Uniform Deceptive Trade Practices Act and the Illinois Consumer Fraud and Deceptive Business Practices Act. The lawsuit accuses ERC Specialists of filing improper ERC claims on behalf of small businesses, potentially exposing them to significant legal and financial risks. This lawsuit highlights risks for businesses, paralleling issues in Synergi Partners lawsuits and potential cases against Innovation Refunds and Bottom Line Concepts.

February 19, 2024

Tax Notes: ERC Challenges by the IRS, to the IRS, and Among Various Parties

February 19, 2024, Tax Notes article by Hale E. Sheppard explores the increasing legal challenges surrounding the Employee Retention Credit (ERC), including issues with Synergi Partners and other third-party ERC promoters. Sheppard detailed how the IRS, grappling with compliance concerns, had referred thousands of ERC cases for audit, following its September 2023 moratorium on processing new claims. The article noted that Synergi Partners, among other firms, has been at the center of disputes over misrepresented ERC eligibility and contingency fees. Additionally, not all third-party payroll or third-party HR providers possess the specialized expertise required to navigate ERC regulations, causing some businesses to face unexpected compliance and legal hurdles. As the IRS intensifies audits and investigations, including criminal probes into fraudulent claims, legal battles are expanding not just between taxpayers and the IRS, but also between businesses and ERC advisors like Synergi Partners, Innovation Refunds, and Bottom Line Specialists. These growing disputes underscore the complexity of navigating ERC claims amidst IRS scrutiny.

January 26, 2024

IRS Commissioner’s Statement on ERC Marketing

In a Forbes article titled "IRS Is Hunting Bad ERC Tax Refund Claims Criminally, Urging Disclosure," IRS Commissioner Daniel Werfel addressed aggressive ERC marketing tactics, stating, "We saw aggressive marketing around this credit, and well-intentioned businesses were misled into filing claims. There’s a limited time window available for these businesses to voluntarily come in and avoid future issues." This statement highlights the IRS’s focus on addressing fraudulent claims and encourages businesses to come forward voluntarily.

January 17, 2024

IRS Rapidly Increasing ERC Examinations by Sending Letter 6612 to Employers

The IRS launched a large-scale audit campaign by mailing Letter 6612 to employers with pending Employee Retention Credit (ERC) claims. This signaled a dramatic increase in enforcement activity. This new wave of audits, requiring employers to submit an extensive list of detailed documentation within a tight 30-day window, immediately heightened the compliance risk for businesses and introduced the threat of full claim disallowance for failure to comply. The development solidified the IRS's shift from processing to aggressive examination, forcing taxpayers to quickly defend their ERC eligibility and prepare for potential litigation.

January 12, 2024

Polk Mechanical Company Sues IRS

Polk Mechanical Company filed a lawsuit against the IRS for inaction on their ERC filings, submitted on January 27, 2022. The suit underscores the frustration businesses face with the IRS’s delayed processing of ERC claims amidst ongoing fraud investigations.

December 21, 2023

IRS Announces Voluntary Disclosure Program for ERC Refunds

On December 21, 2023, the IRS announced procedures for a Voluntary Disclosure Program (VDP) for taxpayers who believe they improperly received Employee Retention Credit (ERC) refunds. The program allows taxpayers to voluntarily return ERC funds they are not entitled to, helping them avoid severe penalties or audits. The IRS’s new program may help mitigate risks for businesses involved in disputes like those seen in the Synergi Partners lawsuits, or who worked with companies like Innovation Refunds and Bottom Line Concepts. This follows the suspension of new ERC filings on September 14, 2023, and the introduction of an ERC claim withdrawal program on October 19, 2023. The deadline to apply for the VDP is March 22, 2024.

December 4, 2023

National Taxpayer Advocate Criticizes ERC Claims Processing

National Taxpayer Advocate Erin Collins criticized the IRS’s handling of ERC claims in an interview with Tax Notes, calling the processing "a mess." Collins highlighted a backlog of 983,000 unprocessed amended employment tax returns, many of which likely involve ERC claims. She warned that legitimate businesses are suffering financial hardships due to the IRS's slow processing and the misleading tactics of some ERC promoters.

December 1, 2023

Southern California Emergency Medicine Inc. vs. IRS

Southern California Emergency Medicine Inc. filed a lawsuit against the IRS and Commissioner Daniel Werfel, challenging the IRS’s guidance in Notice 2021-20, which allegedly restricted ERC payouts. The lawsuit seeks injunctive relief to prevent the IRS from applying these guidelines in a way that limits access to the credit.

November 22, 2023

FinCEN Alert on COVID-19 Employee Retention Credit Fraud

The Financial Crimes Enforcement Network (FinCEN) issued an alert about widespread fraudulent ERC claims. IRS Criminal Investigation (CI) identified over 323 investigations involving more than $2.8 billion in potentially fraudulent ERC claims across tax years 2020 to 2023.This fraud contributed to significant processing delays at the IRS, complicating the review of legitimate ERC claims.

November 9, 2023

Wall Street Journal: "IRS Warns Employers About This One Tactic to Claim Pandemic Tax Credit"

The IRS issued a memo clarifying that Occupational Safety and Health Administration (OSHA) guidelines do not qualify as "government orders" for the purposes of the Employee Retention Credit (ERC). The memo is part of the IRS’s tougher stance on ERC audits, as the agency has seen an increase in claims based on OSHA guidance. The IRS argued that OSHA guidelines encouraging worker safety measures like ventilation and distancing do not meet the legal definition of an order that would justify ERC claims. This memo has significant implications for businesses that have relied on OSHA guidance to qualify for the ERC, potentially leading to legal disputes as the IRS moves to disallow these claims. IRS Commissioner Danny Werfel emphasized that the IRS is targeting aggressive interpretations of ERC eligibility, and the memo may prompt some employers to withdraw their claims or repay refunds.

October 27, 2023

CNBC Article “How Innovation Refunds Cashed In on the Employee Retention Credit”

A CNBC investigation highlighted how Innovation Refunds profited from the ERC by acting as a middleman between small business owners and independent tax attorneys. The company spent millions on marketing and charged a 25% contingent fee for handling ERC claims. After the IRS announced a moratorium on ERC claim processing in September 2023, Innovation Refunds reduced its marketing efforts.

October 7, 2023

Yahoo Finance: "The IRS is Going After Scammy Firms Pushing Small Business Tax Credit"

Yahoo Finance reported on the IRS's crackdown on companies aggressively marketing the Employee Retention Credit (ERC) to small businesses, often referred to as "ERC mills." These firms have persuaded small business owners to file potentially fraudulent ERC claims, leading the IRS to pause the processing of new claims in September 2023. The IRS is now auditing and investigating these claims, with experts predicting criminal cases against the fraudulent firms.

September 14, 2023

Wall Street Journal: "IRS Shuts Door on New Pandemic Tax Credit Claims Until At Least 2024"

The IRS announced an immediate halt to processing new Employee Retention Credit (ERC) claims until at least 2024, in response to a wave of fraudulent and overstated claims. The agency also intensified its scrutiny of the existing backlog of over 600,000 pending claims. Employers with pending claims were given the option to withdraw them, and those who had already received refunds were offered the opportunity to repay if they believed they no longer qualified. The IRS's actions aim to disrupt the "ERC mills," such as Innovation Refunds, Synergi Partners, Bottom Line Concepts, and ERC Specialists, aggressively marketing the credit, which have contributed to an overwhelming number of claims, surpassing the original cost expectations. IRS Commissioner Danny Werfel stated that the agency could no longer tolerate the increase in questionable claims driven by misleading marketing. The agency also warned that employers face potential penalties and interest if they filed ineligible claims, and announced that the scrutiny of existing claims could extend refund processing times significantly.

September 4, 2023

Wall Street Journal Explains: "How an Obscure Tax Break Became a 'Gold Rush'"

The Wall Street Journal released a video titled "How an Obscure Tax Break Became a 'Gold Rush," focusing on Bottom Line Concepts and the Employee Retention Credit (ERC). The video discussed ERC eligibility and featured Josh Fox, owner of Bottom Line Concepts, and his partner Kevin O'Leary, who created WonderTrust to direct businesses to Bottom Line Concepts. The video highlighted the aggressive marketing tactics used to promote ERC services on a contingent fee basis, while O'Leary acknowledged the presence of unscrupulous actors in the ERC space.

July 27, 2023

Testimony by Larry Gray, CPA, to the House Ways and Means Committee

Larry Gray, a CPA with over 20 years of experience as a Government Liaison for the National Association of Tax Professionals, testified before the House Ways and Means Committee about the growing threat of aggressive and misleading third-party ERC mills like Bottom Line Concepts and Innovation Refunds, that target small businesses with improper and often fraudulent claims. Gray shared his firsthand experience dealing with firms like Bottom Line Concepts, ERC Specialists, and Jefferson Duke, which routinely assured businesses they qualified for the Employee Retention Credit (ERC) without properly evaluating their eligibility. Gray stated mills like, like Bottom Line Concepts, failed to ask crucial questions about eligibility, such as whether a government-mandated shutdown or significant revenue decline occurred, leading businesses to unknowingly face liability for improper claims. Gray emphasized the harmful impact on small businesses and ethical tax professionals, who are losing clients to these mills. He warned that these actions undermine the tax system, with improperly claimed ERCs leading to audits, penalties, and long-term financial consequences for unsuspecting business owners.

June 23, 2023

FITSNews: Synergi Partners Facing Scrutiny After ERC Fraud Lawsuits

On June 23, 2023, FITSNews reported that Synergi Partners, a South Carolina-based tax credit consulting firm, is under legal scrutiny for allegedly advising businesses to improperly claim Employee Retention Credits (ERC) and demanding high contingency fees. Lawsuits against Synergi, including one from Marywood University, accused Synergi of providing faulty advice that led to improper claims, with Synergi seeking $900,000 in fees despite the university's ineligibility. Another lawsuit from Dynamic Integrated Services raised similar concerns about Synergi’s inaccurate ERC calculations and fees. Despite these allegations, Synergi claimed it does not offer tax advice or CPA services, raising questions about its practices. The article further linked the issue to broader concerns about firms like Innovation Refunds and Bottom Line Concepts, suggesting the potential for an Innovation Refunds lawsuit and a Bottom Line Concepts lawsuit arising from similar practices.The IRS has warned businesses they are responsible for ensuring their claims are accurate, as investigations into ERC fraud intensify.

March 27, 2023

"ERC Dirty Dozen Debut Reminds Taxpayers to Seek 'Trusted Tax Professional'"

Frost Law published an article discussing the inclusion of the Employee Retention Credit (ERC) on the IRS's 2023 Dirty Dozen list of tax scams. The IRS's Dirty Dozen list highlights the most prevalent and dangerous tax scams, with the ERC making its debut due to a surge in improper claims and fraudulent practices. The article emphasized the importance of consulting with trained and trustworthy tax professionals to properly claim the ERC, given the complex analysis required to determine eligibility. However, not all third-party payroll providers or third-party HR companies are equipped to handle the intricacies of ERC claims, making it crucial for businesses to thoroughly vet any external services before proceeding. Frost Law highlighted that, despite the risks of fraudulent actors, eligible businesses should not be discouraged from claiming the credit. Frost Law encouraged businesses to engage with qualified practitioners to ensure accurate ERC claims and to avoid falling victim to scams.

March 21, 2023

Frost Law: "Caution: Unscrupulous ERC Preparers Leave Taxpayers on the Hook"

Frost Law published an article cautioning businesses about the dangers of unscrupulous tax preparers exploiting the Employee Retention Credit (ERC) program. The article recounted a recent federal grand jury indictment in Utah, where two individuals and their accounting firm were charged with preparing fraudulent ERC claims, defrauding the government of millions of dollars. The article emphasized the importance of consulting a trustworthy tax professional, given the complexity of ERC eligibility and the IRS's increased scrutiny of ERC claims. Such cases highlight the risks of engaging with firms like Synergi Partners, which has faced multiple lawsuits due to questionable ERC advice. The article also highlighted the potential for other firms like Innovation Refunds to encounter legal challenges. Frost Law urged employers to work with reputable, licensed tax practitioners to avoid falling prey to fraudulent preparers and to ensure their ERC claims are legitimate.

January 23, 2023

Frost Law: "ERC Haunted by Ghost Preparers - Who You Gonna Call?"

Frost Law published an article warning about the rise of "ghost preparers" in the Employee Retention Credit (ERC) process. Ghost preparers are individuals or entities that prepare tax returns or related forms, such as Form 941-X, without signing them, leaving taxpayers to submit these forms as "self-prepared." These preparers often disguise themselves as "consultants" or "specialty payroll companies," claiming they are not tax return preparers because they do not charge directly for preparing the forms. The article highlights the significant risks posed by ghost preparers, including potential audits, penalties, interest, and even criminal prosecution for both the preparer and the taxpayer. Frost Law advises businesses to be cautious and seek reputable firms that can provide both tax and legal representation for ERC claims to avoid situations that could lead to lawsuits similar to those seen with Synergi Partners.

November 13, 2022

Wall Street Journal: "Temporary Tax Break Sparks Cottage Industry, Raising IRS Alarms"

The Wall Street Journal highlighted the rise of a cottage industry surrounding the Employee Retention Credit (ERC), as firms aggressively marketed services to help small businesses claim the tax break. One notable incident involved Synergi Partners, a prominent ERC advisory firm, which was sued by Marywood University in June 2022. The university claimed Synergi Partners advised them to file for over $6 million in ERC refunds and sent an invoice for $901,942. However, Marywood’s outside accountants determined the university was not eligible for the credit. The lawsuit was later dismissed, with both parties reaching a mutual resolution. Synergi’s legal officer, Ashley Hogsette, emphasized that the firm does not pressure clients to take credits if they have concerns. The article underscored the risks businesses face when relying on third-party ERC advisory firms, such as Synergi, and the potential for improper claims leading to IRS audits, penalties, and legal disputes.

Additionally, the article noted how ERC advisory firms like Innovation Refunds have been under scrutiny, with mentions of potential legal actions resembling an Innovation Refunds lawsuit. This piece also detailed aggressive marketing tactics used by Bottom Line Concepts, hinting at the potential for a Bottom Line Concepts lawsuit due to rising disputes with clients.

June 28, 2022

Times Tribune: Marywood University Sues Synergi Partners

Marywood University filed a federal lawsuit against Synergi Partners, alleging the tax consulting firm provided faulty advice about the Employee Retention Credit (ERC) under the CARES Act. The university claimed that Synergi wrongly advised them that they qualified for a $6 million ERC, leading to a $900,000 contingency fee demand from Synergi. However, after a review by its auditing firm, CliftonLarsonAllen LLP, Marywood discovered it did not qualify for the credit. Despite this, Synergi allegedly continued to demand its fee. Synergi's CEO, Jim Brown, denied knowledge of the university's concerns and vowed not to seek payment if Marywood was ineligible. This Synergi Partners lawsuit was one of several actions taken against Synergi for similar claims regarding their handling of ERC qualifications.